Blog

How to Get a Loan to Build a House: Step-by-Step Success | RumahHQ

Did you know that nearly 70% of first-time home builders in Malaysia encounter delays due to incomplete loan requirements or missed steps? Building your dream home is an exciting project, but the path to securing a construction loan can be filled with unexpected challenges if your preparation falls short. Knowing exactly what lenders look for and organizing your financial details from the start helps you move forward with confidence and avoid the common pitfalls that derail so many would-be homeowners.

Quick Summary

| Key Point | Explanation |

|---|---|

| 1. Build Strong Financial Readiness | Ensure a credit score of 680 or higher to improve loan eligibility and demonstrate financial responsibility to lenders. |

| 2. Organize Essential Documentation | Create a centralized folder for all necessary financial and construction documents to streamline the loan application process. |

| 3. Compare Loan Options Thoroughly | Investigate various types of construction loans, focusing on interest rates, draw schedules, and government programs to find the best fit for your needs. |

| 4. Present a Comprehensive Application | During the loan application, include complete documentation and be prepared to explain your project’s scope, timeline, and financial details. |

| 5. Understand Loan Approval Details | Review loan approval documents carefully, especially draw schedules and terms, to ensure full understanding of funding structures and requirements. |

Table of Contents

Step 1: Assess Your Financial Readiness

Building your dream home starts with understanding your financial landscape. In this step, you will evaluate your financial preparedness for securing a construction loan and creating a solid foundation for your home project.

Let’s break down what financial readiness truly means. According to financial research, lenders look closely at several key indicators when assessing your loan eligibility. Your credit score is the first checkpoint. Aim for a strong score between 680 and 720 or higher. This range signals to lenders that you are a responsible borrower with a proven track record of managing financial obligations.

Next, gather comprehensive documentation of your income. Lenders will want to see stable employment records, consistent earnings, and detailed income verification. They are essentially checking your ability to repay the loan. Prepare your recent pay stubs, tax returns for the past two years, and employment verification letters.

Calculate your debt-to-income ratio carefully. Research suggests maintaining a ratio around 43% or lower. This means your total monthly debt payments should not exceed 43% of your gross monthly income. To calculate this, add up all your monthly debt payments (credit cards, existing loans, car payments) and divide by your monthly income.

Pro Tip: Create a comprehensive spreadsheet tracking all your financial documents. Organisation impresses lenders and streamlines the loan application process.

Also critical is developing a detailed construction budget and timeline. Lenders want to see you have thoroughly considered project costs, potential contingencies, and a realistic completion schedule. Work with a licensed contractor to create a professional project proposal that demonstrates financial prudence and planning.

What happens next? With a clear picture of your financial health, you will be prepared to approach lenders confidently and start exploring construction loan options tailored to your specific needs and project vision.

Step 2: Gather and Organize Required Documents

Now that you have assessed your financial readiness, it is time to compile the paperwork that will tell your financial story to potential lenders. Think of this step as building a comprehensive portfolio that demonstrates your reliability and project potential.

Start by creating a dedicated folder or digital file specifically for your home construction loan documents. This centralised approach will save you countless hours of searching and help you present a professional application. Lenders appreciate applicants who are organized and prepared.

Your documentation package will typically include several key categories of information. Personal financial records are the foundation. Collect your most recent bank statements covering the past three to six months. Include statements from all accounts checking, savings, investment and retirement accounts. These documents provide a snapshot of your overall financial health.

Employment documentation is next. Gather your recent pay stubs from the past two to three months. If you are self employed, you will need additional documentation. Prepare your past two years of tax returns complete with all schedules, a profit and loss statement for your business, and year to date income verification.

Pro Tip: Create digital and physical copies of all documents. Store them securely but ensure quick accessibility when needed.

Property and construction specific documents come next. Collect your detailed construction plans, contractor estimates, land ownership documents, and project timeline. Include any preliminary architectural drawings or site surveys. The more comprehensive your documentation, the more confident lenders will feel about your project.

Additional important documents include government issued identification proof of address tax identification numbers and any existing property ownership records. If you have previous loan history or mortgage documents those can also strengthen your application.

What happens next? With your meticulously organized documents ready, you are prepared to move forward confidently in the construction loan application process. Your thorough preparation sets the stage for productive conversations with potential lenders.

Step 3: Research and Compare Loan Options

With your financial documents ready, you are now entering the exciting phase of exploring construction loan options that will transform your home building dream into reality. This step is about understanding the financing landscape and finding the perfect loan that matches your project needs.

Global research shows construction-to-permanent loans are becoming increasingly popular. According to market analysis, this financing model has grown significantly, reaching a market size of USD 78.2 billion in 2024. These loans offer a convenient single-close approach that simplifies the financing process for homeowners.

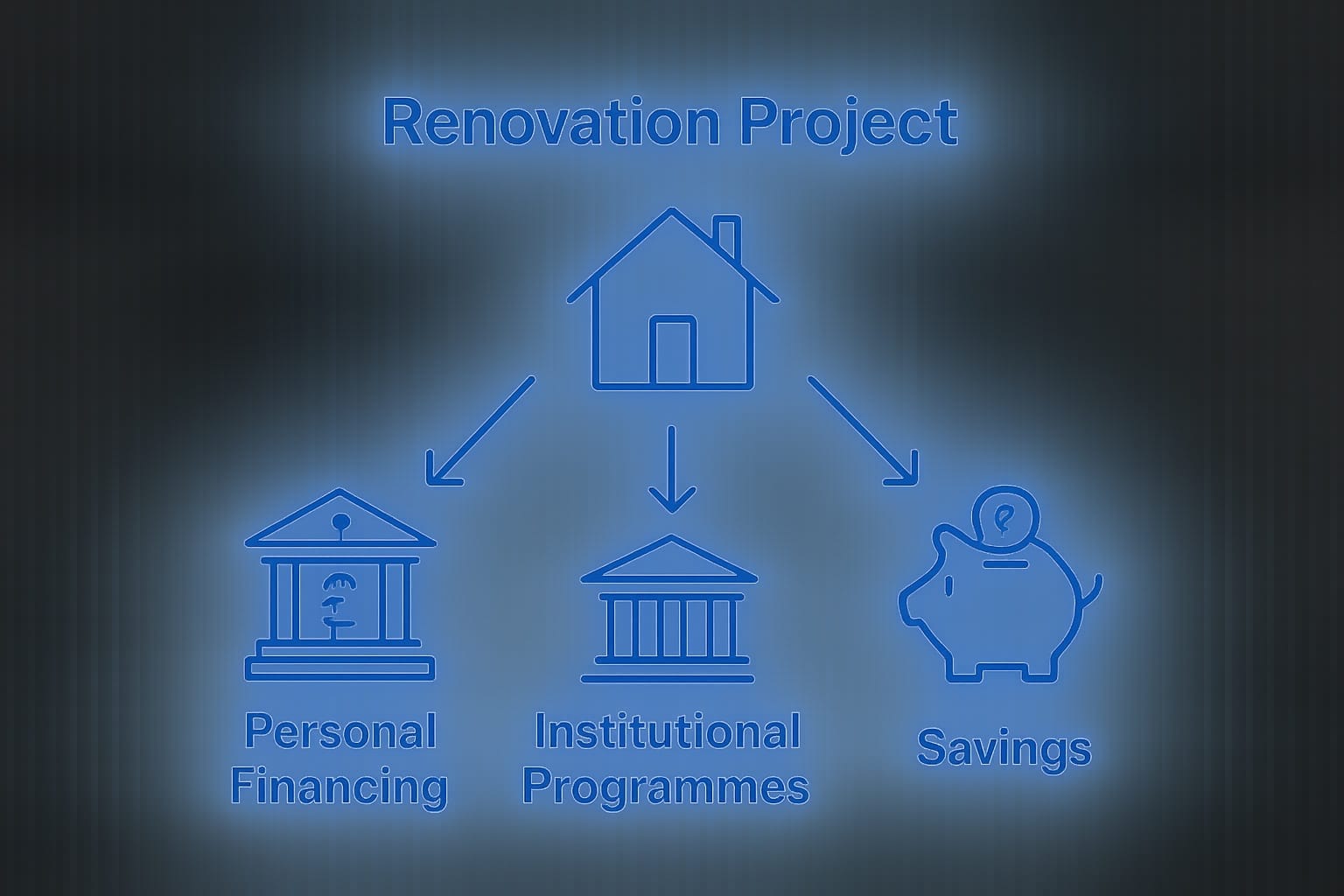

Start by understanding the primary loan types available in Malaysia. Traditional construction loans differ from permanent mortgages in their structure. Typically, these loans provide short term financing during the building phase with the ability to convert into a long term mortgage once construction is complete. Look for lenders who specialize in construction financing and offer flexible terms.

Compare interest rates carefully. Construction loans often have variable rates during the building phase, which means your interest can fluctuate. Some lenders offer fixed-rate options that provide more predictability. Request detailed loan estimates from multiple financial institutions to understand the true cost of borrowing.

Pro Tip: Request loan estimates from at least three different lenders. Compare not just interest rates, but also origination fees, draw schedule flexibility, and conversion terms.

Pay special attention to the loan draw schedule. Construction loans typically release funds in stages as your building project progresses. Understand how and when these fund disbursements will occur. Some lenders require detailed progress reports and inspections before releasing subsequent payments.

Consider government supported loan programs that might offer more favorable terms. In Malaysia, schemes like LPPSA, KWSP, and KMMB provide specialized financing options for homeowners. These programs often have more lenient requirements and competitive interest rates.

Here’s a comparison of the main construction loan types available in Malaysia:

| Loan Type | Description | Key Benefits | Common Requirements |

|---|---|---|---|

| Construction-To-Permanent | Single loan covers construction & mortgage phases | One set of closing costs Simplifies transition |

Good credit score Detailed project plan |

| Traditional Construction Only | Provides funds for building phase only | Flexible use of funds Tailored to large projects |

Higher documentation Full repayment after completion |

| Government Schemes (e. |

g. LPPSA, KWSP, KMMB) | Loans with state support or incentives | Lower interest

g. LPPSA, KWSP, KMMB) | Loans with state support or incentives | Lower interest

Lenient eligibility

Special subsidies | Meet scheme criteria

Proof of eligibility |

What happens next? Armed with comprehensive loan comparisons, you will be ready to select the financing option that best aligns with your construction project goals and financial capabilities.

Step 4: Submit Your Loan Application

You have done the groundwork and are now ready to transform your home building dream into an official loan application. This step requires precision attention to detail and strategic presentation of your financial story.

Begin by scheduling an initial consultation with your chosen lender. This meeting is more than a formality it is your opportunity to demonstrate your preparedness and project viability. Bring all the documents you carefully organized earlier your financial statements, construction plans, and detailed project timeline.

Complete the loan application form meticulously. Every section matters. Double check all entries for accuracy. Lenders will scrutinize every detail, so ensure consistency across all documents. If you are working with a construction contractor, include their credentials and project proposal as part of your application package.

Prepare to provide additional context about your project. Lenders want to understand not just the financial numbers but the story behind your construction plans. Be ready to explain your project scope, timeline, anticipated challenges, and how you plan to manage potential risks.

Pro Tip: Learn about construction loan secrets that banks might not openly share which could give you an edge in your application process.

Expect the lender to conduct a thorough review. They may request further documentation or clarifications. Respond promptly and professionally to any inquiries. Your responsiveness demonstrates your commitment and reliability.

Some lenders might require a property appraisal or additional site evaluation. Be prepared to facilitate these assessments. Provide clear access to your construction site and be ready to answer questions about your building plans.

What happens next? After submission, enter a phase of patient follow up. Maintain open communication with your lender, be proactive in providing any additional information they might need, and stay positive about moving closer to your home building goals.

Step 5: Verify Approval and Finalize Construction Funding

Congratulations! You have reached a pivotal moment in your home building journey. This step involves carefully reviewing and confirming the details of your approved construction loan and establishing the financial framework for your project.

When your loan approval arrives, read through every document meticulously. The approval letter will outline critical details including your loan amount, interest rate, draw schedule, and specific terms and conditions. Pay close attention to the loan disbursement structure some lenders release funds in stages tied to specific construction milestones.

Schedule a comprehensive loan closing meeting. This is your opportunity to clarify any remaining questions and understand the precise mechanics of how your construction funds will be managed. During this meeting, confirm the draw schedule which determines how and when funds will be released to your contractor as construction progresses.

Establish a dedicated construction bank account specifically for your project funds. This separates your construction finances from personal accounts and provides clear financial tracking. Most lenders will require this as part of their funding management protocol.

Pro Tip: Create a detailed spreadsheet tracking each fund draw, matching it with specific project milestones to ensure transparent financial management.

Understand the inspection and verification processes that will accompany each fund draw. Typically, lenders will require periodic site inspections to confirm that construction is progressing according to the approved plans before releasing subsequent funding tranches.

Review the contingency provisions in your loan agreement. Most construction loans include a buffer for unexpected expenses typically ranging between 10% to 15% of your total project budget. Understand how these contingency funds can be accessed and under what circumstances.

What happens next? With your construction funding verified and structured, you are now ready to transition from financial planning to actual ground breaking. Your careful preparation sets the stage for a smooth and successful home building experience.

Ready to Secure Your Construction Loan and Simplify Home Building?

You have just learned a step-by-step approach to getting a home construction loan, but the paperwork, budget planning, and lender requirements can feel overwhelming. Maybe you are concerned about gathering the right documents, finding the best loan programme, or simply keeping your project on track. At RumahHQ, we understand how confusing financial readiness and loan applications can be, especially when dreaming of your ideal home.

Why navigate it all alone? RumahHQ offers not only transparent construction project management but also financial guidance tailored to Malaysian homeowners. We provide free design consultations, fixed-price project packages, and support for government loan schemes like LPPSA, KWSP, and KMMB, making the process simpler from start to finish. Explore how our all-in-one end-to-end solutions can help you organise documents, secure planning approvals, and connect you with approved lenders. If you want to get started with a custom quote or learn about your financing options, visit RumahHQ today and see how easy building your new home can be—even if you have a tight budget or are a first-time builder. Take action now. Make your dream home a reality with expert support, clear pricing, and financial peace of mind.

Frequently Asked Questions

What initial steps should I take to get a loan to build a house?

Start by assessing your financial readiness, which includes evaluating your credit score, gathering income documentation, and calculating your debt-to-income ratio. Create a detailed construction budget and timeline to present to lenders, which will help you confidently approach loan options.

How do I organize documents for my construction loan application?

Create a dedicated folder for all documents related to your construction loan, including personal financial records, employment documentation, and property-specific paperwork. This organized approach will streamline the application process and show lenders that you are prepared.

What types of construction loans are available, and how do I choose one?

There are various types of construction loans, including construction-to-permanent loans and traditional construction-only loans. Compare options by looking at interest rates, draw schedules, and other terms to find one that aligns best with your financial situation and project needs.

What information do I need to include in my loan application?

Your loan application should include all financial documents, construction plans, and a detailed project timeline. Be prepared to explain the scope of your project and any risks involved to give lenders a complete picture of your plans.

How do I verify the approval details of my construction loan?

Once you receive your loan approval, review the documents carefully, focusing on the loan amount, interest rate, and draw schedule. Schedule a closing meeting to clarify any questions and understand how funds will be managed throughout your construction process.

What should I do if my loan application is denied?

If your loan application is denied, review the feedback from your lender to understand the reasons. Take specific actions to improve your financial standing, such as paying down debt or boosting your credit score, and then consider reapplying.

Recommended

Source link

kontraktor rumah

bina rumah

pinjaman lppsa

pengeluaran kwsp

spesifikasi rumah

rumah batu-bata

pelan rumah

rekabentuk rumah

bina rumah atas tanah sendiri

kontraktor rumah selangor

rumah banglo