Blog

Kalkulator Kelayakan Pinjaman Perumahan LPPSA

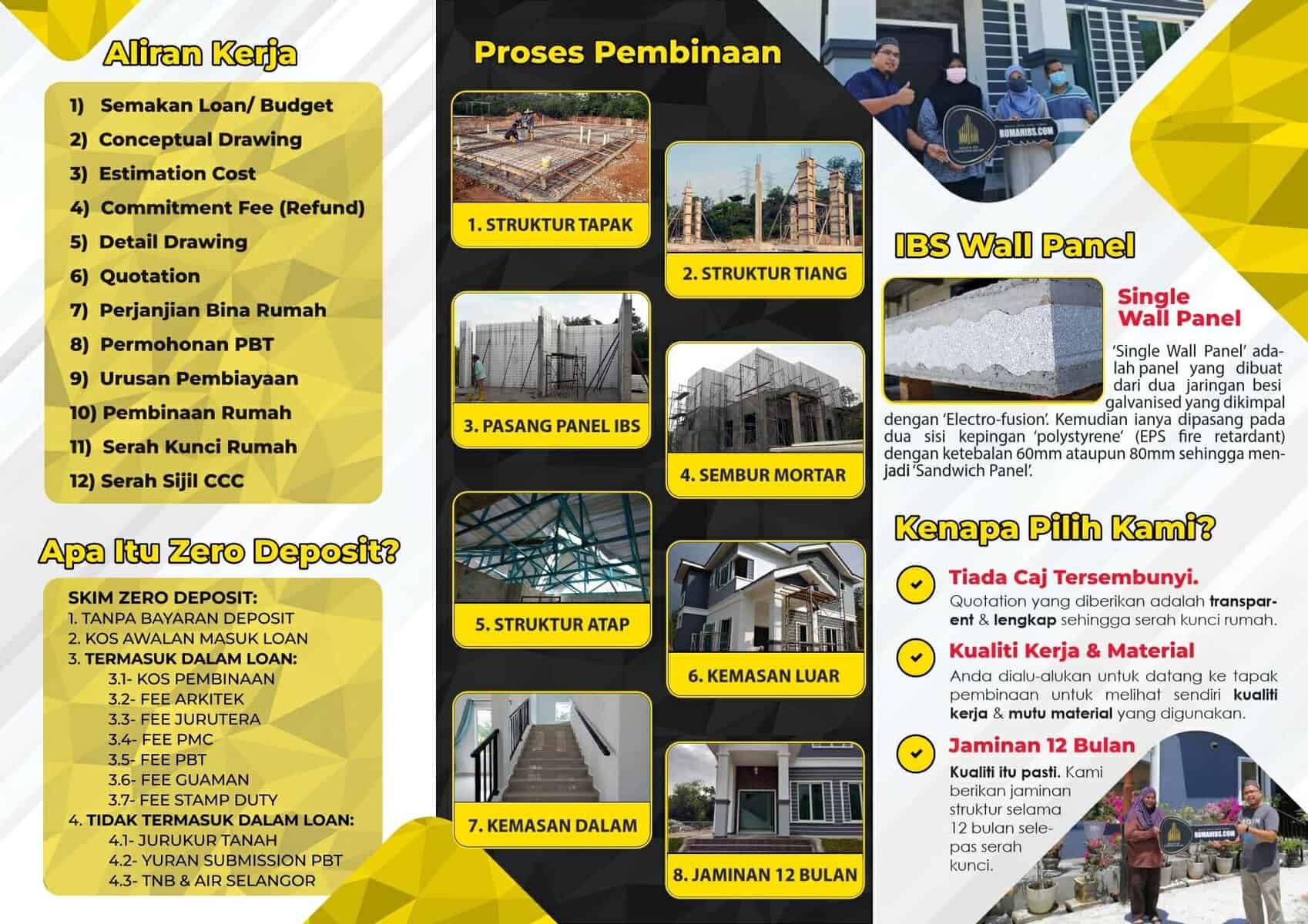

Pengenalan kepada Kalkulator Kelayakan Pinjaman Perumahan LPPSA

Kalkulator Kelayakan Pinjaman Perumahan LPPSA adalah alat yang sangat berguna untuk individu yang berhasrat untuk memiliki rumah sendiri melalui skim pinjaman perumahan LPPSA. Alat ini membolehkan pengguna untuk mengetahui kelayakan pinjaman mereka berdasarkan beberapa faktor seperti pendapatan, komitmen kewangan dan skor kredit.

Definisi Kalkulator Kelayakan Pinjaman Perumahan LPPSA

Kalkulator Kelayakan Pinjaman Perumahan LPPSA adalah alat digital yang direka untuk membantu individu mengetahui berapa banyak pinjaman perumahan yang mereka layak terima berdasarkan maklumat kewangan mereka.

Kelebihan Menggunakan Kalkulator Kelayakan Pinjaman Perumahan LPPSA

Menggunakan Kalkulator Kelayakan Pinjaman Perumahan LPPSA mempunyai banyak kelebihan. Ia memudahkan proses permohonan pinjaman dan membantu individu merancang kewangan mereka dengan lebih baik.

Cara Menggunakan Kalkulator Kelayakan Pinjaman Perumahan LPPSA

Langkah-langkah Menggunakan Kalkulator

Menggunakan Kalkulator Kelayakan Pinjaman Perumahan LPPSA adalah proses yang mudah dan cepat. Anda hanya perlu memasukkan beberapa maklumat kewangan seperti pendapatan bulanan, jumlah komitmen kewangan dan skor kredit anda.

Keputusan dan Interpretasi

Setelah memasukkan semua maklumat yang diperlukan, kalkulator akan mengira jumlah pinjaman yang anda layak terima. Keputusan ini akan membantu anda merancang kewangan anda dengan lebih baik.

Bagaimana Kalkulator Kelayakan Pinjaman Perumahan LPPSA Bekerja

Kalkulator Kelayakan Pinjaman Perumahan LPPSA bekerja dengan mengambil kira beberapa faktor penting yang mempengaruhi kelayakan pinjaman anda.

Faktor-faktor yang Mempengaruhi Kelayakan Pinjaman

Pendapatan dan Komitmen Kewangan

Pendapatan dan komitmen kewangan anda adalah dua faktor utama yang mempengaruhi kelayakan pinjaman anda. Pendapatan yang lebih tinggi dan komitmen kewangan yang lebih rendah akan meningkatkan kelayakan pinjaman anda.

Skor Kredit

Skor kredit anda juga mempengaruhi kelayakan pinjaman anda. Skor kredit yang baik menunjukkan bahawa anda adalah peminjam yang bertanggungjawab, yang akan meningkatkan kelayakan pinjaman anda.

Keputusan Kalkulator dan Langkah Seterusnya

Memahami Keputusan Kalkulator

Keputusan kalkulator bukanlah keputusan muktamad. Ia hanyalah anggaran berdasarkan maklumat yang anda berikan. Anda harus berjumpa dengan penasihat kewangan atau pegawai bank untuk mendapatkan keputusan rasmi.

Bagaimana untuk Meningkatkan Kelayakan Pinjaman

Jika anda tidak berpuas hati dengan keputusan kalkulator, terdapat beberapa langkah yang boleh anda ambil untuk meningkatkan kelayakan pinjaman anda. Ini termasuk meningkatkan pendapatan anda, mengurangkan komitmen kewangan anda, dan meningkatkan skor kredit anda.

Kesimpulan

Kalkulator Kelayakan Pinjaman Perumahan LPPSA adalah alat yang sangat berguna yang boleh membantu anda merancang kewangan anda dan memahami berapa banyak pinjaman perumahan yang anda layak terima.

Artikel FAQ: Kalkulator Kelayakan Pinjaman Perumahan LPPSA

1. Apakah Kalkulator Kelayakan Pinjaman Perumahan LPPSA?

Kalkulator Kelayakan Pinjaman Perumahan LPPSA adalah alat digital yang direka untuk membantu individu mengetahui berapa banyak pinjaman perumahan yang mereka layak terima berdasarkan maklumat kewangan mereka. Alat ini memudahkan proses permohonan pinjaman dan membantu individu merancang kewangan mereka dengan lebih baik.

2. Bagaimana cara menggunakan Kalkulator Kelayakan Pinjaman Perumahan LPPSA?

Menggunakan Kalkulator Kelayakan Pinjaman Perumahan LPPSA adalah proses yang mudah dan cepat. Anda hanya perlu memasukkan beberapa maklumat kewangan seperti pendapatan bulanan, jumlah komitmen kewangan dan skor kredit anda. Setelah memasukkan semua maklumat yang diperlukan, kalkulator akan mengira jumlah pinjaman yang anda layak terima.

3. Apakah faktor-faktor yang mempengaruhi kelayakan pinjaman saya?

Terdapat beberapa faktor yang mempengaruhi kelayakan pinjaman anda. Ini termasuk pendapatan bulanan anda, jumlah komitmen kewangan anda dan skor kredit anda. Pendapatan yang lebih tinggi dan komitmen kewangan yang lebih rendah akan meningkatkan kelayakan pinjaman anda. Sebaliknya, skor kredit yang baik menunjukkan bahawa anda adalah peminjam yang bertanggungjawab, yang akan meningkatkan kelayakan pinjaman anda.

4. Bagaimana saya boleh meningkatkan kelayakan pinjaman saya?

Terdapat beberapa langkah yang boleh anda ambil untuk meningkatkan kelayakan pinjaman anda. Ini termasuk meningkatkan pendapatan anda, mengurangkan komitmen kewangan anda, dan meningkatkan skor kredit anda. Anda juga boleh berbincang dengan penasihat kewangan untuk mendapatkan nasihat yang lebih terperinci dan personal.

5. Apakah langkah seterusnya selepas mendapatkan keputusan dari Kalkulator Kelayakan Pinjaman Perumahan LPPSA?

Selepas mendapatkan keputusan dari Kalkulator Kelayakan Pinjaman Perumahan LPPSA, langkah seterusnya adalah untuk berjumpa dengan penasihat kewangan atau pegawai bank untuk mendapatkan keputusan rasmi. Keputusan kalkulator bukanlah keputusan muktamad, tetapi hanyalah anggaran berdasarkan maklumat yang anda berikan.