Blog

Cara Mudah Lulus Pinjaman LPPSA untuk Memiliki Rumah Idaman

Cara Mudah Lulus Pinjaman LPPSA untuk Memiliki Rumah Idaman

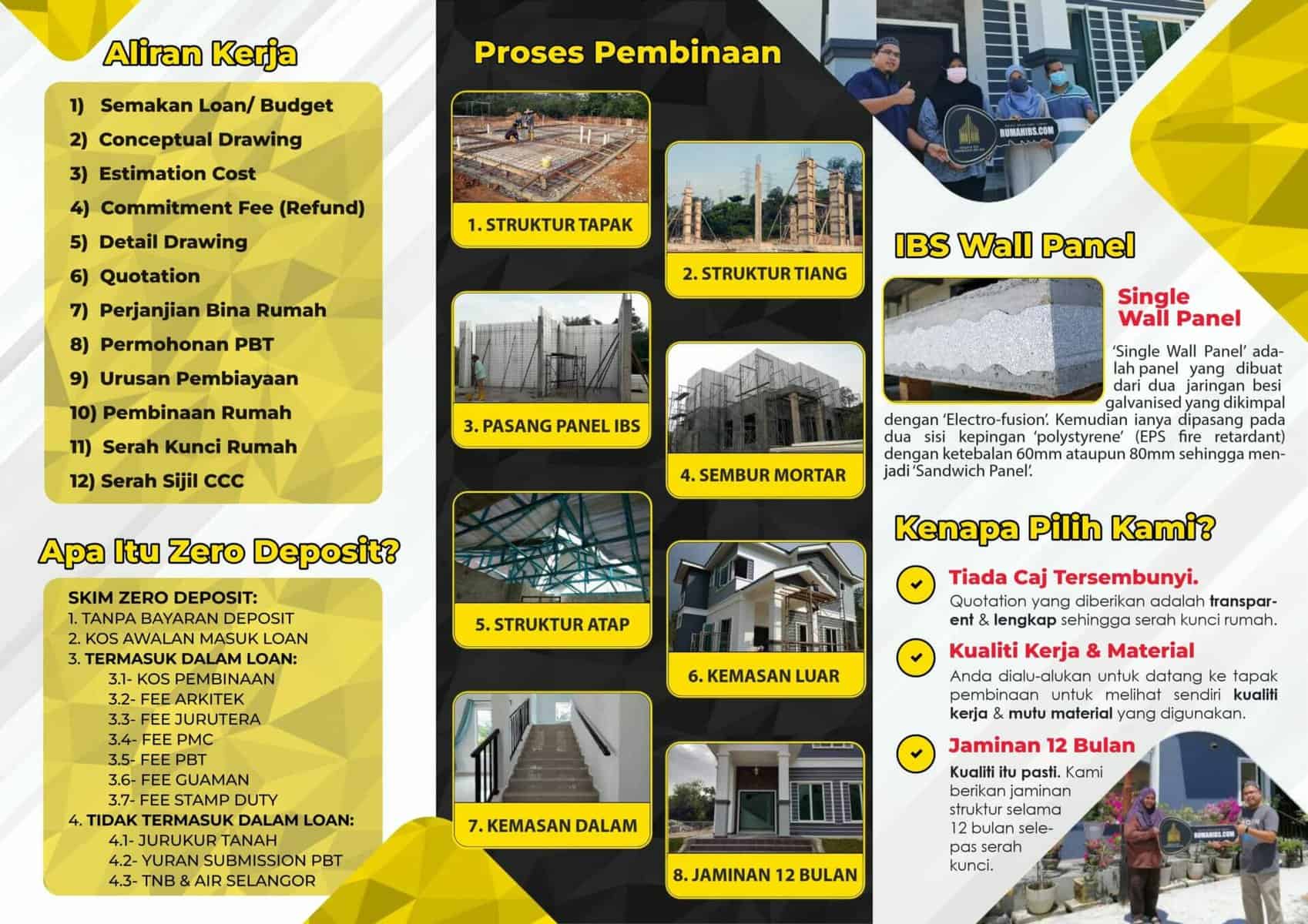

Selamat datang ke artikel ini yang akan membahas tentang cara mudah untuk lulus pinjaman LPPSA dan memiliki rumah idaman Anda sendiri. Apabila Anda berencana untuk bina rumah atas tanah sendiri dan memerlukan pinjaman LPPSA untuk mewujudkan impian tersebut, artikel ini adalah panduan yang tepat untuk Anda. Kami, Masjaya Eco Construction, akan memandu Anda melalui langkah-langkah penting dan memberikan informasi berguna tentang pinjaman LPPSA, kalkulator LPPSA, dan kontraktor rumah yang dapat membantu Anda mewujudkan rumah idaman Anda.

Daftar Isi:

- Apa itu Pinjaman LPPSA?

- Apa itu Lembaga Pinjaman Perumahan Sektor Awam (LPPSA)?

- Kelebihan Pinjaman LPPSA untuk Bina Rumah

- Syarat-syarat Kelayakan Pinjaman LPPSA

- Langkah-langkah Memohon Pinjaman LPPSA

- Daftar Ahli LPPSA

- Kumpulkan Dokumen-dokumen yang Diperlukan

- Pengiraan Kelayakan Pinjaman melalui Kalkulator LPPSA

- Bagaimana Cara Memohon Pinjaman LPPSA?

- Pemilihan Kontraktor Rumah yang Tepat

- Peranan Kontraktor Rumah dalam Projek Pembinaan

- Kriteria Pemilihan Kontraktor Rumah yang Baik

- Mengapa Pilih Masjaya Eco Construction?

- Tips Membina Rumah atas Tanah Sendiri

- Lakukan Kajian Pasaran Tanah

- Pilih Reka Bentuk Rumah yang Sesuai

- Berkerja dengan Arkitek Profesional

- Berunding dengan Kontraktor Rumah

- Perhatikan Kualiti Bahan Binaan

- Peranan LPPSA dalam Projek Pembinaan Rumah

- Proses Penilaian Projek Pembinaan Rumah oleh LPPSA

- Pelan Pembayaran Pinjaman LPPSA

- Kelebihan Menggunakan Khidmat Kontraktor Rumah Profesional

- Keahlian dan Pengalaman dalam Industri Pembinaan

- Jaminan Kualiti dan Kepuasan Pelanggan

- Penyelesaian Projek yang Tepat Waktu

- Panduan Menguruskan Projek Pembinaan Rumah

- Perancangan dan Perolehan Kebenaran Menduduki (PPK)

- Proses Pembinaan Rumah dari Mula hingga Tamat

- Faktor-faktor yang Mempengaruhi Kelulusan Pinjaman LPPSA

- Rekod Kredit yang Baik

- Nisbah Hutang dan Pendapatan (DSR)

- Penilaian Hartanah oleh Pihak Bank

- Bagaimana Meningkatkan Peluang Kelulusan Pinjaman LPPSA?

- Bayar Hutang yang Sedia Ada

- Kurangkan Beban Hutang

- Tingkatkan Pendapatan

- Kebenaran Menduduki (PPK) dan Kelayakan Pinjaman

- Pentingnya Kebenaran Menduduki (PPK)

- Impak Kelayakan Pinjaman LPPSA

- Jenis-jenis Pinjaman LPPSA

- Pinjaman Pembelian Rumah

- Pinjaman Rumah Bina Sendiri

- Pinjaman Pendahuluan Rumah

- Cara Pengiraan Faedah Pinjaman LPPSA

- Cara Mengira Faedah Pinjaman LPPSA

- Kelebihan Pinjaman LPPSA dengan Faedah Tetap

- FAQ (Pertanyaan Lazim)

Kami akan bina rumah berdasarkan budget yang anda tentukan. Kos ini merangkumi kerja-kerja awalan & pembinaan struktur rumah. Construction: RM160 psf

Preliminary: RM20,000 Construction: RM190 psf

Preliminary: RM20,000 Hanya Masukkan Angka, Tanpa Koma ( , ). Contoh: 1000 Bina rumah lebih mudah dengan pembiayaan kewangan. Additional Cost: RM4 psf No Additional Cost No Additional Cost Kos ini merangkumi Fee Arkitek, Jurutera & PMC. Kelulusan PBT adalah wajib jika anda menggunakan pembiayaan LPPSA/BANK. Consultant Fee: RM50,000 No Additional Cost No Additional Cost Kami juga ada sediakan servis lukis pelan rumah untuk anda. Kami boleh bantu untuk mohon meter tersebut (optional) TNB & SYABAS: RM4,500 No Additional Cost Senarai penuh dan perbezaaan 2 spesifikasi ini akan dilampirkan dalam email anda. Full Spec: RM49 psf Low Spec: RM9 psf Sila isi butiran berikut. Kami akan hantar quotation & senarai penuh spesifikasi ke email anda.

BERAPAKAH KOS BINA RUMAH SAYA?

Terima kasih, kami akan hubungi anda secepat mungkin.

Rumah 1 Tingkat Ataupun 2 Tingkat?

Berapakah Luas Keseluruhan Rumah Anda?

Apakah Jenis Pembiayaan Rumah Anda?

Anda Perlu Mohon Kelulusan Pelan Bangunan?

Sudah Ada Pelan Rumah Tersebut?

Meter Kekal TNB & SYABAS

Full Spec ataupun Low Spec?

Anggaran Kos Bina Rumah Anda Adalah :

Ringkasan

Deskripsi

Informasi

Kuantiti

Kos

Discount : Total :

1. Apa itu Pinjaman LPPSA?

Apa itu Lembaga Pinjaman Perumahan Sektor Awam (LPPSA)?

Lembaga Pinjaman Perumahan Sektor Awam (LPPSA) adalah sebuah agensi yang ditubuhkan oleh Kerajaan Malaysia untuk menyediakan kemudahan pinjaman kepada kakitangan sektor awam dan anggota polis. Tujuan utama LPPSA adalah untuk membantu pekerja sektor awam memiliki rumah idaman dengan memudahkan akses kepada pembiayaan perumahan.

Kelebihan Pinjaman LPPSA untuk Bina Rumah

Pinjaman LPPSA menawarkan beberapa kelebihan kepada pemohon, antaranya termasuk:

- Faedah Pinjaman Rendah: Pinjaman LPPSA menawarkan kadar faedah yang rendah berbanding dengan pinjaman perumahan dari institusi kewangan swasta.

- Tempoh Bayaran Fleksibel: Pemohon boleh memilih tempoh bayaran yang fleksibel, membuatnya lebih mudah untuk menguruskan pembayaran bulanan.

- Pelan Pembayaran yang Mudah: LPPSA membolehkan pemohon membayar melalui potongan gaji secara langsung, mengelakkan kelewatan bayaran.

- Peluang Memiliki Rumah Sendiri: Pinjaman LPPSA membuka peluang kepada kakitangan sektor awam dan anggota polis untuk memiliki rumah sendiri walaupun tanpa simpanan yang besar.

Syarat-syarat Kelayakan Pinjaman LPPSA

Untuk layak memohon pinjaman LPPSA, pemohon perlu memenuhi beberapa syarat, antaranya:

- Seorang kakitangan sektor awam atau anggota polis dengan perkhidmatan tetap.

- Mempunyai rekod kredit yang baik dan tidak mempunyai sebarang hutang yang tertunggak.

- Nisbah hutang dan pendapatan (DSR) yang bersesuaian untuk memohon jumlah pinjaman yang dikehendaki.

- Berumur antara 18 hingga 58 tahun pada masa permohonan.

2. Langkah-langkah Memohon Pinjaman LPPSA

Daftar Ahli LPPSA

Langkah pertama untuk memohon pinjaman LPPSA adalah mendaftar sebagai ahli LPPSA. Pemohon perlu melengkapkan borang pendaftaran dan menyertai dokumen-dokumen yang diperlukan seperti salinan kad pengenalan, slip gaji terkini, dan penyata bank.

Kumpulkan Dokumen-dokumen yang Diperlukan

Selepas mendaftar sebagai ahli LPPSA, pemohon perlu mengumpulkan semua dokumen-dokumen yang diperlukan untuk permohonan pinjaman. Dokumen-dokumen ini termasuk surat pengesahan jawatan, penyata gaji, penyata bank, dan borang permohonan pinjaman LPPSA.

Pengiraan Kelayakan Pinjaman melalui Kalkulator LPPSA

Sebelum membuat permohonan pinjaman secara rasmi, pemohon boleh menggunakan kalkulator LPPSA untuk mengira kelayakan pinjaman. Kalkulator ini akan membantu pemohon memahami jumlah pinjaman yang layak diperoleh berdasarkan pendapatan dan komitmen kewangan pemohon.

Bagaimana Cara Memohon Pinjaman LPPSA?

Setelah dokumen-dokumen disiapkan dan kelayakan pinjaman diira, pemohon bolehlah membuat permohonan secara rasmi. Permohonan boleh dibuat melalui portal dalam talian LPPSA atau di kaunter cawangan LPPSA yang berhampiran.

Melalui langkah-langkah di atas, pemohon berpeluang untuk lulus pinjaman LPPSA dengan lancar dan mewujudkan impian memiliki rumah idaman sendiri.

3. Pemilihan Kontraktor Rumah yang Tepat

Peranan Kontraktor Rumah dalam Projek Pembinaan

Kontraktor rumah memainkan peranan penting dalam menjayakan projek pembinaan rumah atas tanah sendiri. Mereka bertanggungjawab untuk menguruskan keseluruhan proses pembinaan dari permulaan hingga penyiapan rumah untuk diduduki.

Kriteria Pemilihan Kontraktor Rumah yang Baik

Berikut adalah beberapa kriteria yang boleh membantu pemilik tanah memilih kontraktor rumah yang berkualiti:

- Pengalaman dan Reputasi: Pilih kontraktor rumah yang mempunyai pengalaman yang mencukupi dan reputasi baik dalam industri pembinaan.

- Lesen dan Permit: Pastikan kontraktor mempunyai lesen dan permit yang sah untuk menjalankan projek pembinaan.

- Portfolio Kerja Terdahulu: Lihat portfolio kerja terdahulu kontraktor untuk memahami kualiti hasil kerja yang dihasilkan.

- Kualiti Bahan Binaan: Pastikan kontraktor menggunakan bahan binaan berkualiti tinggi untuk memastikan rumah tahan lama dan selamat.

Mengapa Pilih Masjaya Eco Construction?

Masjaya Eco Construction adalah syarikat pembinaan yang berpengalaman dan komited untuk menyediakan khidmat pembinaan berkualiti tinggi. Dengan kepakaran kami dalam pembinaan rumah atas tanah sendiri, kami berusaha untuk memberikan kepuasan pelanggan yang maksimum dan melampaui jangkaan. Hubungi kami hari ini untuk maklumat lanjut tentang perkhidmatan kami.

4. Tips Membina Rumah atas Tanah Sendiri

Lakukan Kajian Pasaran Tanah

Sebelum memulakan pembinaan, lakukan kajian pasaran tanah untuk mendapatkan tanah dengan lokasi yang strategik dan harga yang berpatutan. Kajian pasaran ini akan membantu pemilik tanah membuat keputusan yang bijak sebelum membeli tanah untuk projek pembinaan.

Pilih Reka Bentuk Rumah yang Sesuai

Reka bentuk rumah adalah penting untuk mencapai rumah idaman yang diimpikan. Pemilik tanah perlu bekerjasama dengan arkitek untuk merancang reka bentuk rumah yang sesuai dengan keperluan dan citarasa keluarga.

Berkerja dengan Arkitek Profesional

Sewaktu merancang reka bentuk rumah, pastikan bekerjasama dengan arkitek profesional yang mempunyai kepakaran dalam reka bentuk bangunan. Arkitek akan membantu menghasilkan pelan yang tepat dan mematuhi peraturan dan undang-undang yang berkaitan.

Berunding dengan Kontraktor Rumah

Sebaik sahaja pelan reka bentuk rumah siap, berundinglah dengan kontraktor rumah untuk menilai kos pembinaan dan melaksanakan projek dengan cekap. Jangan ragu untuk bertanya dan mendapatkan penjelasan daripada kontraktor tentang langkah-langkah pembinaan yang akan diambil.

Perhatikan Kualiti Bahan Binaan

Pastikan hanya menggunakan bahan binaan berkualiti tinggi untuk rumah atas tanah sendiri. Kualiti bahan binaan yang baik akan memastikan rumah tahan lama dan selamat untuk ditempati.

Melalui tips-tips di atas, pemilik tanah akan lebih berkeyakinan dan bersedia untuk memulakan projek pembinaan rumah idaman.

5. Peranan LPPSA dalam Projek Pembinaan Rumah

Proses Penilaian Projek Pembinaan Rumah oleh LPPSA

LPPSA akan menilai projek pembinaan rumah atas tanah sendiri sebelum meluluskan pinjaman. Proses penilaian ini melibatkan pemeriksaan kelayakan pemohon, kajian ke atas kelayakan projek pembinaan, dan penentuan jumlah pinjaman yang boleh diberikan.

Pelan Pembayaran Pinjaman LPPSA

LPPSA menawarkan beberapa pilihan pelan pembayaran pinjaman yang boleh dipilih oleh pemohon. Pemohon boleh memilih pelan bayaran yang bersesuaian dengan keperluan kewangan mereka.

6. Kelebihan Menggunakan Khidmat Kontraktor Rumah Profesional

Keahlian dan Pengalaman dalam Industri Pembinaan

Kontraktor rumah profesional seperti Masjaya Eco Construction mempunyai keahlian dan pengalaman yang luas dalam industri pembinaan. Mereka akan menjalankan projek pembinaan dengan cekap dan berkualiti tinggi.

Jaminan Kualiti dan Kepuasan Pelanggan

Kontraktor rumah yang berpengalaman biasanya menawarkan jaminan kualiti untuk hasil kerja mereka. Ini memberikan ketenangan fikiran kepada pemilik tanah tentang kualiti rumah yang akan dihasilkan.

Penyelesaian Projek yang Tepat Waktu

Kontraktor rumah profesional akan berusaha untuk menyiapkan projek pembinaan dalam jangka masa yang telah ditetapkan. Mereka akan bekerjasama dengan pemilik tanah untuk memastikan penyelesaian projek yang tepat waktu.

Melalui penggunaan khidmat kontraktor rumah profesional, pemilik tanah boleh yakin bahawa projek pembinaan rumah atas tanah sendiri akan berjalan dengan lancar dan menghasilkan hasil kerja yang berkualiti tinggi.

7. Panduan Menguruskan Projek Pembinaan Rumah

Perancangan dan Perolehan Kebenaran Menduduki (PPK)

Langkah awal dalam menguruskan projek pembinaan rumah adalah merancang projek secara teliti. Pemilik tanah perlu mendapatkan kebenaran menduduki (PPK) daripada pihak berkuasa tempatan sebelum memulakan pembinaan.

Proses Pembinaan Rumah dari Mula hingga Tamat

Proses pembinaan rumah melibatkan beberapa fasa seperti persiapan tapak, pembinaan struktur, pemasangan utiliti, dan kerja-kerja penyiapan akhir sebelum rumah siap diduduki. Pengurusan yang cermat diperlukan untuk memastikan kesemua fasa berjalan lancar dan mengikut jadual yang ditetapkan.

Melalui panduan menguruskan projek pembinaan rumah ini, pemilik tanah akan lebih bersedia untuk mengendalikan projek dengan berkesan dan berjaya.

8. Faktor-faktor yang Mempengaruhi Kelulusan Pinjaman LPPSA

Rekod Kredit yang Baik

Rekod kredit yang baik adalah faktor penting dalam kelayakan pinjaman LPPSA. Pastikan bayaran hutang dan pinjaman sedia ada dibuat secara tepat dan tidak terdapat sebarang rekod kelewatan bayaran.

Nisbah Hutang dan Pendapatan (DSR)

Nisbah hutang dan pendapatan (DSR) memainkan peranan penting dalam menentukan jumlah pinjaman yang layak diberikan. Pastikan nisbah hutang dan pendapatan adalah dalam lingkungan yang bersesuaian dengan persyaratan LPPSA.

Penilaian Hartanah oleh Pihak Bank

LPPSA akan melibatkan pihak bank untuk menilai hartanah yang ingin dibina. Pastikan hartanah dinilai dengan betul dan mendapatkan nilai yang adil sebelum membuat permohonan pinjaman LPPSA.

Melalui pemahaman tentang faktor-faktor yang mempengaruhi kelulusan pinjaman LPPSA, pemohon akan dapat membuat langkah-langkah yang tepat untuk meningkatkan peluang kelulusan pinjaman.

9. Bagaimana Meningkatkan Peluang Kelulusan Pinjaman LPPSA?

Bayar Hutang yang Sedia Ada

Jika mempunyai hutang yang sedia ada, pastikan hutang tersebut dibayar dengan tepat sebelum membuat permohonan pinjaman LPPSA. Hal ini akan membantu meningkatkan rekod kredit dan meningkatkan kelayakan pinjaman.

Kurangkan Beban Hutang

Jika memungkinkan, kurangkan beban hutang dengan melunaskan hutang yang sedia ada sebelum memohon pinjaman LPPSA. Ini akan membantu meningkatkan nisbah hutang dan pendapatan (DSR) dan meningkatkan peluang kelulusan pinjaman.

Tingkatkan Pendapatan

Jika memungkinkan, cuba tingkatkan pendapatan dengan mencari peluang untuk bekerja lebih banyak atau mencari pendapatan tambahan. Pendapatan yang lebih tinggi akan meningkatkan kelayakan pinjaman.

Dengan mengambil langkah-langkah untuk meningkatkan peluang kelulusan pinjaman LPPSA, pemohon akan lebih berkeyakinan untuk membuat permohonan pinjaman.

10. Kebenaran Menduduki (PPK) dan Kelayakan Pinjaman

Pentingnya Kebenaran Menduduki (PPK)

Kebenaran menduduki (PPK) adalah proses mendapatkan kelulusan dari pihak berkuasa tempatan untuk menduduki rumah yang telah dibina. PPK adalah syarat yang penting sebelum LPPSA meluluskan pinjaman.

Impak Kelayakan Pinjaman LPPSA

Kelayakan pinjaman LPPSA boleh dipengaruhi oleh kebenaran menduduki (PPK). Pastikan PPK telah diperolehi sebelum membuat permohonan pinjaman untuk meningkatkan peluang kelulusan.

11. Jenis-jenis Pinjaman LPPSA

Pinjaman Pembelian Rumah

Pinjaman pembelian rumah adalah pinjaman yang diberikan kepada pemohon untuk membeli rumah yang sedia ada. Pemohon boleh memilih rumah yang dijual di pasaran dan memohon pinjaman LPPSA untuk membiayai pembelian tersebut.

Pinjaman Rumah Bina Sendiri

Pinjaman rumah bina sendiri adalah pinjaman yang diberikan kepada pemohon untuk membiayai pembinaan rumah atas tanah sendiri. Pemohon boleh membangun rumah idaman mereka sendiri dengan pinjaman ini.

Pinjaman Pendahuluan Rumah

Pinjaman pendahuluan rumah adalah pinjaman sementara yang diberikan kepada pemohon untuk membayar deposit rumah sebelum pinjaman LPPSA disahkan. Pinjaman ini membantu pemohon menyediakan deposit rumah dengan lebih mudah.

Melalui pemahaman tentang jenis-jenis pinjaman LPPSA ini, pemohon boleh memilih jenis pinjaman yang sesuai dengan keperluan mereka.

12. Cara Pengiraan Faedah Pinjaman LPPSA

Cara Mengira Faedah Pinjaman LPPSA

Faedah pinjaman LPPSA boleh diira menggunakan rumus yang ditetapkan oleh LPPSA. Pemohon boleh merujuk kepada borang kalkulator faedah yang disediakan oleh LPPSA untuk mengira jumlah faedah yang perlu dibayar.

Kelebihan Pinjaman LPPSA dengan Faedah Tetap

Salah satu kelebihan pinjaman LPPSA adalah faedah tetap sepanjang tempoh pinjaman. Ini bermaksud pemohon akan tahu dengan pasti jumlah faedah yang perlu dibayar setiap bulan, memudahkan pengurusan kewangan.

FAQ (Pertanyaan Lazim)

1. Apakah syarat utama untuk memohon pinjaman LPPSA?

Untuk memohon pinjaman LPPSA, pemohon perlu menjadi ahli LPPSA dan merupakan kakitangan sektor awam atau anggota polis dengan perkhidmatan tetap. Selain itu, pemohon perlu mempunyai rekod kredit yang baik dan nisbah hutang dan pendapatan (DSR) yang bersesuaian.

2. Berapa lama tempoh kelulusan pinjaman LPPSA?

Tempoh kelulusan pinjaman LPPSA bergantung kepada beberapa faktor seperti kelengkapan dokumen dan keadaan permohonan. Biasanya, tempoh kelulusan boleh mengambil masa beberapa minggu hingga beberapa bulan.

3. Adakah pemohon perlu membayar yuran pemprosesan pinjaman LPPSA?

Ya, pemohon perlu membayar yuran pemprosesan pinjaman LPPSA. Yuran ini adalah yuran pemprosesan permohonan dan biasanya tidak akan dikembalikan sekiranya pinjaman tidak diluluskan.

4. Bagaimana kalkulator LPPSA membantu dalam pengiraan pinjaman?

Kalkulator LPPSA membantu pemohon mengira kelayakan pinjaman berdasarkan pendapatan dan komitmen kewangan pemohon. Pemohon boleh menggunakan kalkulator ini untuk menentukan jumlah pinjaman yang layak diperoleh.

5. Apa peranan sebuah kontraktor rumah dalam pembinaan rumah atas tanah sendiri?

Kontraktor rumah memainkan peranan penting dalam menguruskan keseluruhan proses pembinaan rumah atas tanah sendiri. Mereka bertanggungjawab untuk merancang, melaksanakan, dan menyiapkan projek pembinaan rumah dengan cekap dan berkualiti tinggi.

6. Adakah Masjaya Eco Construction menawarkan jaminan kualiti?

Ya, Masjaya Eco Construction menawarkan jaminan kualiti untuk hasil kerja pembinaan kami. Kami berusaha untuk memberikan hasil kerja yang berkualiti tinggi dan memastikan kepuasan pelanggan yang maksimum.

7. Bagaimana cara untuk menghubungi Masjaya Eco Construction?

Anda boleh menghubungi Masjaya Eco Construction melalui WhatsApp di nombor +60163547300 atau menghubungi kami di talian +6016-3547300. Hubungi kami hari ini untuk maklumat lanjut tentang perkhidmatan kami.

Kesimpulan

Memiliki rumah idaman atas tanah sendiri adalah impian banyak individu. Untuk mencapai impian ini, pinjaman LPPSA dapat menjadi alternatif yang baik untuk membantu membiayai pembinaan rumah. Dengan mengikuti panduan dan tips yang disediakan dalam artikel ini, pemohon akan lebih mudah lulus pinjaman LPPSA dan menjayakan projek pembinaan rumah impian mereka.

Sebagai kontraktor rumah yang berpengalaman, Masjaya Eco Construction berkomitmen untuk memberikan khidmat pembinaan berkualiti tinggi dan memberikan kepuasan pelanggan yang maksimum. Hubungi kami hari ini untuk maklumat lanjut dan kami akan dengan senang hati membantu mewujudkan rumah idaman Anda atas tanah sendiri.